Let's take a quick walk down K Street.

Located in Washington DC, it's the lobbying capital of the United States, on nearly the same level of notoriety as New York City's Wall Street - at one point, almost all of the top 20 lobbying firms in the nation had an address here. Although some have moved out, it's still the metonym for private corporations wielding political influence.

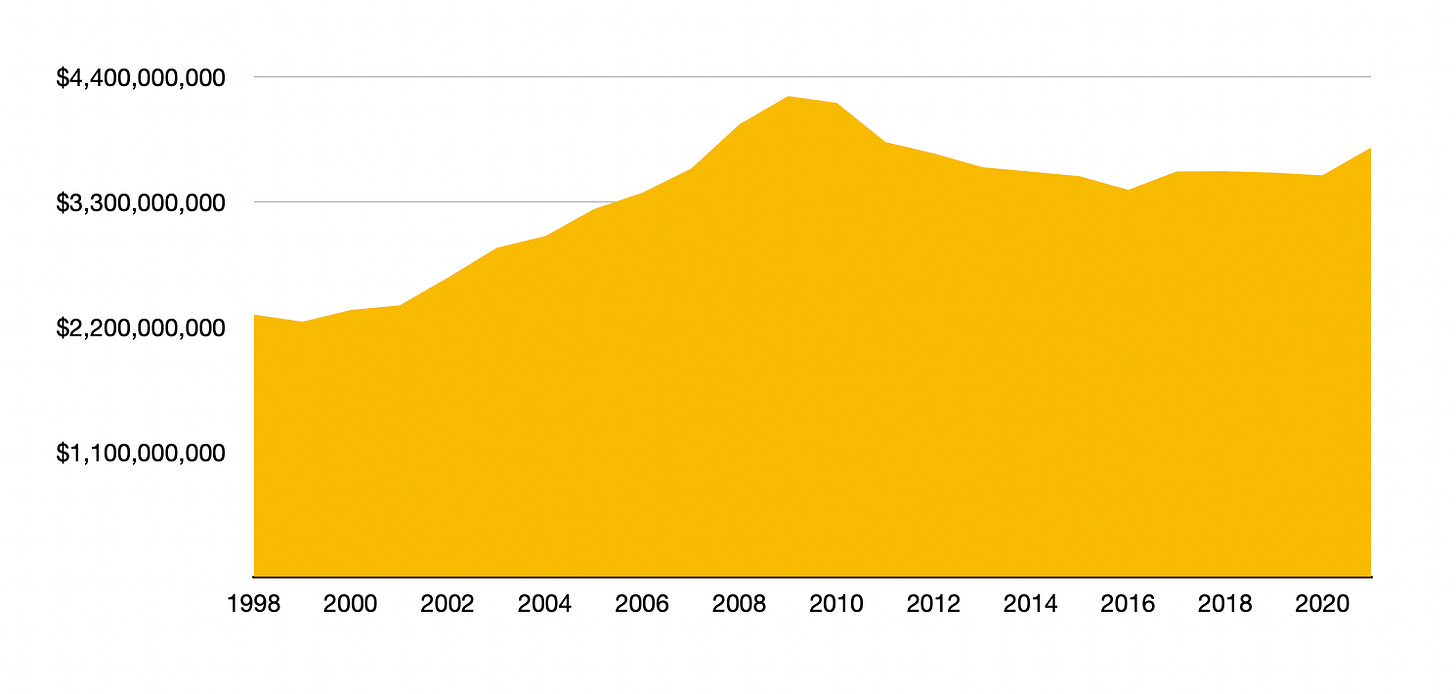

About $4B is spent on political lobbying every year, with the heyday being in the early 2010s, peaking out at $4.23B. These lobbyists influence the government on issues of labor, ideological, as well as business/private interests. It's all generally pretty above-board, with periodic lobbying disclosure reports filed with the Secretary of the Senate's Office of Public Records (SOPR), and published on their website, and lobbying firms being required to provide a good-faith estimate rounded to the nearest $10,000 of all lobbying-related income (aka who is paying them to lobby on behalf of what). Also, organizations that hire in-house lobbyists are also required to provide good-faith estimates rounded to the nearest $10,000 of all their quarterly lobbying-related expenditures.

From 1998 to 2010, lobbying spending increased at a CAGR of 5.6%, inflation-adjusted. In that same timeframe, the S&P had a CAGR - from the midst of the internet boom to the midst of the great recession - of -1.9% total. That's about an 18% decrease overall.

If there's insidious things going on in the world of lobbying, it's covered up pretty well and some private parties are getting über-rich. Speculating on all that doesn't interest us as much as looking at the data that is collected, cleaned and aggregated for us all to see. Because, as we'll see, there's stuff we can glean from this data that paints very interesting stories.

The players

Around 87% of lobbying spending comes from businesses with a material interest in the economic outcomes of that lobbying spending. This split is pretty robust, and has stayed around 87% since at least 2008. Within this group, who's lobbying the most? How does this translate into returns for those lobbyists? We looked at a cross section of companies that have spent above $10,000 in lobbying, categorized into sectors, and then compared these to indices that tracked those sectors.

Here's a quick analysis. We used the following ETFs to track the returns of the following sectors, corresponding to sectors represented in the pie chart above:

Healthcare: IYH (iShares US Healthcare)

Utilities: IDU (iShares US Utilities)

Financial companies: XLF (Financial Select Sector SPDR)

Communications: XLC (Communication Services Select Sector SPDR)

Agribusiness: MOO (lol; VanEck Agribusiness)

Energy: XLE (Energy Select Sector SPDR)

Transportation: XTN (SPDR S&P Transportation)

Defense: ITA (iShares US Aerospace & Defense)

Construction: ITB (iShares US Home Construction)

Spurious positive correlation between outperformance and lobbying on a sector basis, at best. The performance you see for the energy-tracking ETF, XLE, is an outlier caused by factors outside of government lobbying: we can see that sector does lobby quite a bit, but still less than 4 other sectors, one of which, XLC, is underwater. Let's remind ourselves: we weren't likely to see any results on a sector-wide basis. Not every company in any sector - or even anywhere close to the vast majority - lobbies the government.

Anyways, we launched a strategy with our partner Quiver that started off with similar research but dug deeper, and tracks this stuff. Two flavors of it: one, Top Lobbying Spenders, tracks how much companies spend on lobbying the government on a quarterly basis. The second one, Lobbying Spending Growth, tracks this spending on a longer-term, quarter-over-quarter basis. Both rebalance monthly and allocate 10% each to 10 different stocks. Let's talk about the first real quick, before comparing how these two flavors stack up:

Top Lobbying Spenders

Stats:

Last month return: -10.8%

YTD return: -21.56%

5-year return: 37.77%

Return since inception: 537%

Alpha: 0.01

Max Drawdown: -31.50%

Sharpe: 0.75

How it performed in COVID drop (Mar 2020): 12.0%

How it performed in great recession aftermath (Mar 2009 to Mar 2011): 80.3%

SPY (stats since Lobbying inception, 2009):

Last month return: -7.97%

YTD return: -22.44%

5-year return: 47.49%

Return since Lobbying inception: 437.62%

Alpha: 0.0

Max Drawdown: -32.20%

Sharpe: 0.90

How it performed in COVID drop (Mar 2020): -16.23%

How it performed in great recession aftermath (Mar 2009 to Mar 2011): 89.84%

Learn more of the ins and outs of Top Lobbying Spenders.

In the stats above, we see great returns over the time horizon of the fund from inception, but the return profile over the past 5 years, plus the Sharpe Ratio, are quite similar to just buying the market (S&P 500). This tells us that the fund was about as risky as investing in the S&P, with its huge upswings in the past half-decade, as well as its sharp downturn in 2020 and its frequent volatile downturns over the past year. If we run a correlation between this fund's and the S&P's returns since 2009, this thesis is corroborated with a 91% correlation between the returns.

We then tested to see whether this increase in correlation was only due to the larger amount of public interest in government lobbying over the last few years - this would have meant we would have seen higher correlations in the last 5 years or so, with the highest over the last two years, with considerably lower return correlations pre-2017. This, however, ended up not being the case, with the correlations actually being higher pre-2017 (where the fund outperformed the S&P) and lowest on average since then.

Overall, what we take this to mean is that there does seem to be some sort of explanatory factor in returns that comes from whether or not a company lobbies Congress, and that this warrants further exploration - without trying to overfit the data (aka trying to do lots of mini-optimizations on the data to try to beat the S&P using historical backtests). The hypothesis here is pretty straightforward - Okay, so we know that companies that are lobbying Congress are getting some kind of benefit out of it. Do we think this benefit comes in the form of immediate business profits, or do we think this takes some time to show up? And do we think that, if it's working, business will quit lobbying, keep the same amount of spending in lobbying, or do more of what works? The hypothesis tested here was the latter - that the benefit is slightly slow-acting (takes about a quarter to show up on a company's income statement) and that they would double down on a good thing.

So here's the data on that.

Lobbying Spending Growth

Here are the stats for the strategy that invests in companies that *increase* lobbying spending quarter-over-quarter, since inception in 2009:

Last month return: -13.04%

YTD return: -27.5%

5-year return: 255.5%

Return since inception: 3,500%

Max Drawdown: -42.8%

Alpha: 0.10

Sharpe: 1.03

How it performed in COVID drop (Mar 2020): 19.5%

How it performed in great recession aftermath (Mar 2009 to Mar 2011): 299.4%

And again, S&P stats to compare easily:

Last month return: -7.97%

YTD return: -22.44%

5-year return: 47.49%

Return since Lobbying inception: 437.62%

Alpha: 0.0

Max Drawdown: -32.20%

Sharpe: 0.90

How it performed in COVID drop (Mar 2020): -16.23%

How it performed in great recession aftermath (Mar 2009 to Mar 2011): 89.84%

You can immediately see that, even though this strategy has been ~15% more volatile over the last year, it more than pays for that volatility with the returns it's generated since 2017 (as well as general outperformance during COVID). That's reflected in the Sharpe ratio - on a volatility vs. return basis, each unit of risk (in general, percentage of volatility) pays for itself with a bit more than one unit of return, about 15% more than the S&P has generated. This effect is even stronger pre-2017, which bakes into an overall 30% CAGR since inception in 2009. With a correlation to the S&P of about 78%, it moves a good amount with the market, but is clearly doing more than index-tracking. Our thesis about longer-term returns from lobbying might be checking out. More on this next week, though.

For more information on why this strategy has worked for the last 13 years, check out the fund methodology and details here.

Read our previous research on Congressional-based investment strategies

Read about tracking Nancy Pelosi