A Congressional Trading Index Fund

We've talked in lots of detail before about what tracking Pelosi's investments is like. She had her heyday in 2021, like pretty much every fund manager (returning double the S&P in the year and a half post-COVID), but numbers go down, mean reversion happens, and 2022 hasn't been that great for her.

Turns out there's other interesting things happening when you look at government trading data. Today, I'll be introducing you to the first of three government-based funds that Quantbase is launching - this one tracks the stocks that Congress buys, when members of Congress report their holdings.

Congress Buys

I think the idea of representatives trading on insider data + abusing their positions has been played out in a social media sense - at least on my feed, I see it every 5th post, and everyone's talking about it. At the very least, we've been tracking it for 8 months at this point.

Turns out it's not yet played out in a financial returns sense. If you track the performance of stocks that Congress members or their family members have taken long positions in, you can make some interesting returns - this is something we've been able to backtest back to early 2020, and the returns are still outperforming the S&P as a benchmark on a monthly basis.

Let's take a look at the stats:

- Last month return: -4.1%

- YTD return: 9.7%

- Return since inception: 183%

- Beta: 1.12

- Alpha: 0.20

- Max Drawdown: -22.80%

- Sharpe: 1.56

A quick note on beta and alpha:

A beta of 1.12 implies that for every 1% the market moved up, the fund ought to have moved up 1.12% (and vice versa for down), since it's a bit more volatile than the market. In simplistic terms (without factoring in other costs), a 2x leveraged S&P fund would have a beta of 2.0. It goes up 2% when the market goes up 1%, and vice versa. It's not doing much other than amplifying market risk.

Now, the alpha of 0.20 for the Congress Buys fund implies that a lot of the return over the last two years isn't just from amplifying risk, but from something else (which investors call edge or skill)

Alpha is equal to: return - riskless return - beta * (market return - riskless return)

Assuming a portfolio returns 10%, the risk-free return (US Treasury bonds, because the only risk here is that the US gov't will default, which the financial space deems risk-free) is 1%, the market returns 8%, and over time the stock's covariance with the market (beta) is shown to be 0.5, the stock has an alpha of 0.045, or 4.5%. Of the stock's 10% return, 5.5% of it was just because of the market, and the other 4.5% came from the portfolio managers' "skill."

So the alpha for this portfolio, at 20%, is quite high for the time period it has run in.Well. Positive YTD return, almost triple return since inception in 2020, and a very promising alpha. Looks like there's something here. Let's dig into the data.

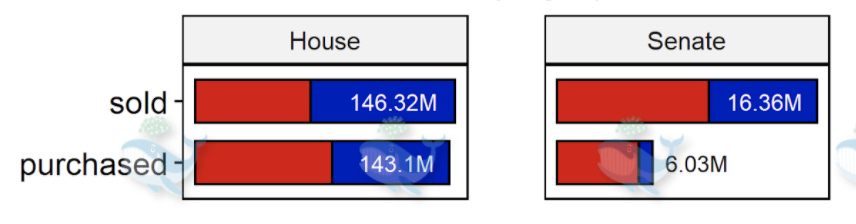

According to our own analyses of public house/senate financial reports, about $400M worth of stock securities and related derivates were traded in 2021. This number is also strong so far this year, at $232M. Lots of Congressmembers make trades. Here are some graphics depicting how many transactions a given member of Congress has enacted since the start of 2022.

Figures 1 and 2: Total Number of Trades per Senator, Total Number of Trades per House Rep in 2022

18 of 100 senators have made a total of 496 trades this year, and 101 of 435 House representatives have made a total 2,533 trades. Looking at the data, it's clear that the trading is quite concentrated to just a few members who are doing it prolifically. Many of them don't have registered trades at all.

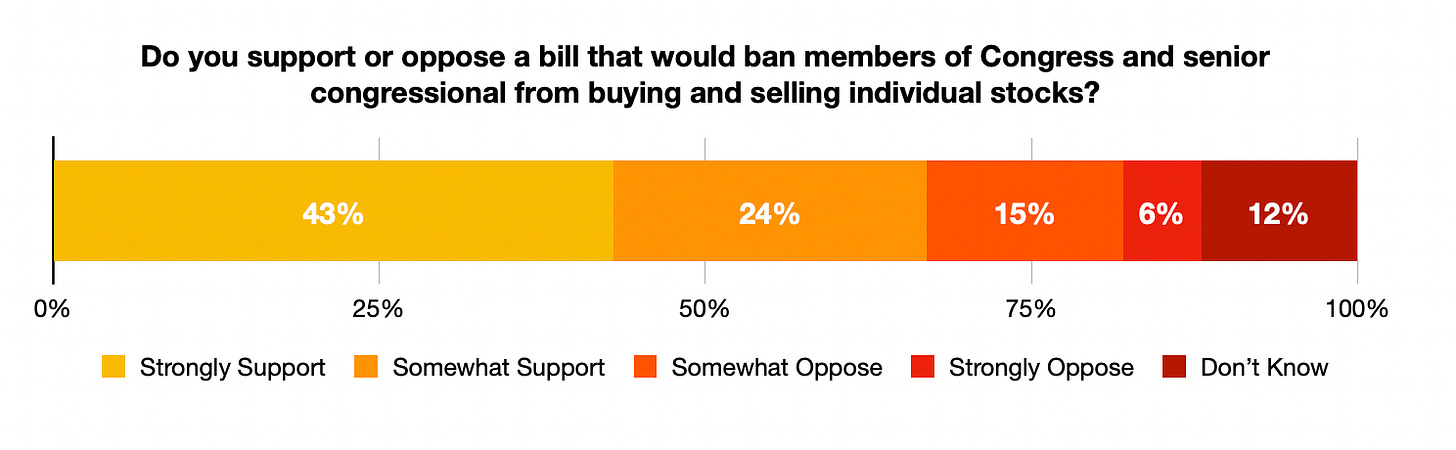

And it looks like these other members are the ones pushing forward a bipartisan agreement to ban the practice - the Ban Congressional Stock Trading Act and Ban Insider Trading Congress Act are two different bill implementations with slightly different details that would require members (and parts of their immediate family) to either divest their investments or transfer them to a blind trust. It's unclear whether any will pass: in December 2021 at a press conference, Pelosi was asked about whether Congressional lawmakers should be banned from trading stocks - her reply was "We’re a free-market economy. They should be able to participate in that."

Pelosi holds a sentiment that the US public across the aisle strongly disagrees with, according to this poll from Data for Progress.

Figure 3: Data for Progress poll on US support

Our investment philosophy at Quantbase is indifferent to Congressional trading as long as trades are being reported correctly (it looks like it's working?). If that's the case, we - as a firm that implements government-based trading strategies - benefit from the transparency. In a short-term sense, if Congress beats the market by trading, and we're able to mimic Congress trades, then we'll be able to beat the market by trading. The more minds that follow along this thought process, the quicker this gap between the market and Congress trades narrows, and we'll eventually see less/no outperformance.

On a longer-term and broader financial markets sense, the transparency in how Congress trades gives us an insight into how the government interplays/interacts with the private market, which is a powerful insight that allows us to start constructing market factors like the traditional Fama-French variety. There's an idea in efficient markets called strong-form market efficiency. Very few people actually believe in strong-form efficiency, but it's a concept that purports that market prices reflect all available information - including private information (weak-form efficiency purports that market prices reflect all publicly available information). Adding information that Congress members might have to market prices through a fund that tracks Congressional trades is one way of increasing efficiency, essentially laundering private information into public information.

So in general - yes, it's a bad thing that members of Congress can trade on what might be insider information/knowledge (aka private info), and it’s true that all the information representatives are presented with should be public knowledge (and thus incorporated quickly into market prices). Until that legal gap is solved, it seems like there's legal alpha to be reaped by following Congressional investments.

In fact, the good folks over at Quantbase and Quiver have already started building a number of government-based factors and investment funds. To start allocating your capital towards these funds, check out our partners page here.

Read more of our research on Congressional-based investment strategies

Read about social media-based investing

Read about how to make money in a bear market

PS: a few graphs made by our friend Unusual Whales to describe the state of Congressional trading at EOY 2021:

Figure 4: Total Value of Equities Traded by Congress in 2021 (assuming max disclosed values; labels indicate total values per group per asset; red = Republican, blue = Democrat, gray = Independent)

Figure 5: Total Value of Stocks Purchased by Congress in 2021, by Month

Figure 6: Top 10 Stocks Bought by House Reps in 2021

Figure 7: Top 10 Stocks Bought by Senators in 2021