Beating the Bear Market with Government Money

Top government contract recipients continue to outperform the market

There is no bigger consumer in the United States than the federal government. The sheer amount of money the government spends on subsidies and goods is enough to make any business’ mouth water: a total of $637b in 2021 spent across all government contractors, slightly less than the entire market capitalization of Berkshire Hathaway.

Beyond this raw number, this budget is spent with little regard for the market cycle - even spiking during down-markets, so the firms able to capture a cut of this receive a significant stable revenue source that others miss even while private money gets risk-averse.

The result is clear. Consider otherwise (somewhat) similar firms: consumer-oriented aerospace firm United Airlines ($UAL) and aerospace firm Northrop Grumman ($NOC). United Airlines celebrated a reopening America following the Covid-19 lockdowns, with its revenue rocketing up 66% from September 2021. This sharp jump looked to be a strong recovery following 2 tough years for the firm, but the situation since has worsened for them. Consumer demand for travel and other discretionary expenditures has been in steep decline with a tightening job market, inflation headwinds, and supply chain challenges. On the supply side, United is battered by rising fuel costs, increasing commodities prices, and the same supply chain complications. The result is a stock that has fallen -3.7% YTD - fairing better than the broader market at least, but the situation isn’t rosy. Like many consumer-oriented firms, United is tied closely to the business cycle - and now is a terrible time for this coupling.

The picture is nearly the reverse for Northrop Grumman. Since the start of the year, Northrop Grumman has jumped an impressive 35%, all while the rest of the market finds itself in the gutter. Their revenue has remained strong, and federal contracts continue to dominate it, resulting in a stable source of continued growth for the firm.

This pattern repeats itself again and again, and is most pronounced in the current market, where private money is harder to attract.

With this in mind, we developed a strategy in partnership with our friends at Quiver to take advantage of this strong performance. Our approach is straightforward, selecting the top 20 recipients of government contracts on a monthly basis, weighted by the values of the announced contracts. Then, company by company, their contract value is measured with an exponential moving average (to favor more recent contracts), while still giving weight to historical contracts.

As evident from the chart, this strategy has returned 15.8% over the last year - while the market is down -17.4% (a 33.2% premium). At the same time, this strategy maintains low volatility despite the strong returns. These firms have been able to reap a stable source of revenue despite the pullback in the private markets, with trends indicating that government spending is countercyclical, increasing this fuel, especially in tough economic conditions like we’re currently seeing.

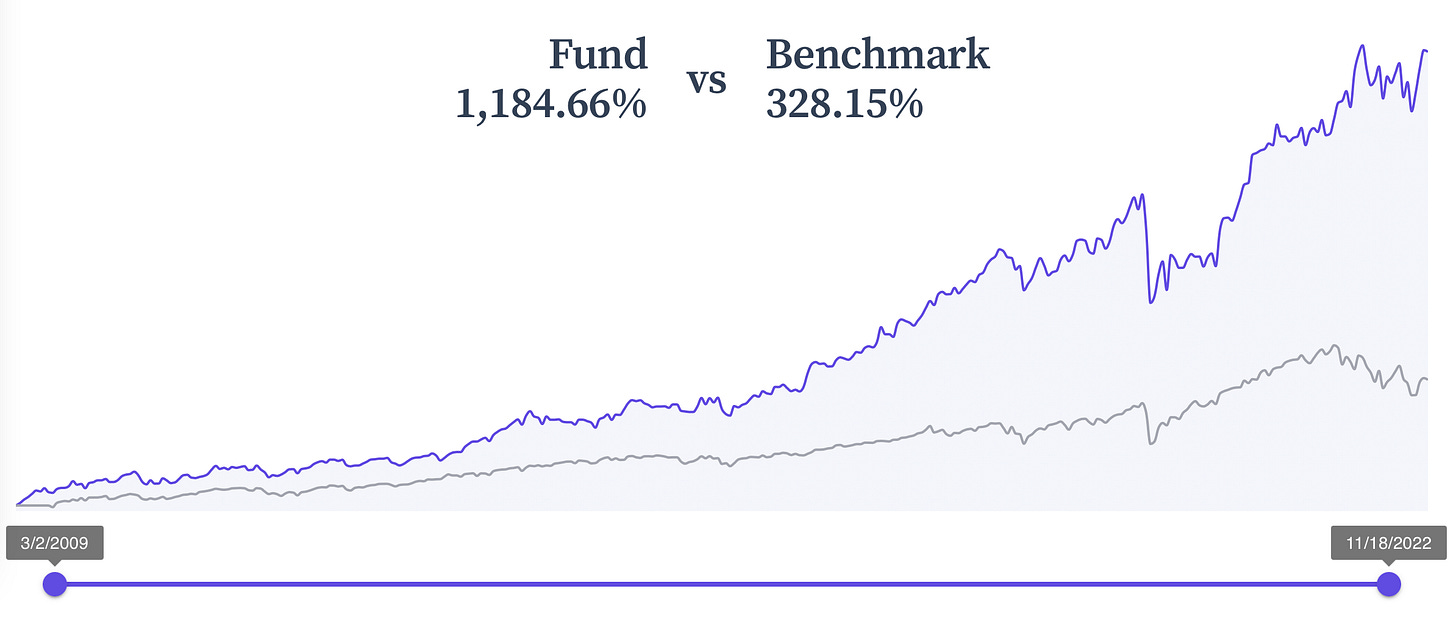

While excellent this year, what about historically? We ran this strategy as far back as we could grab data - to March 2009. During this same period, the S&P has performed strongly. This last decade and change was the longest bull market the nation has seen, with a total market cumulative return of +328%. Apple became the first trillion dollar company with a few firms to follow them, IPOs grew quickly during this period, and SPACs burst into the mainstream. The decade was capped with a dip with the Covid fears, but rapidly made up the difference as crypto boomed, NFTs exploded, and the metaverse became a mainstream concept. All told, an excellent decade for the market in general.

Now, if we look at just the firms winning the most government contracts over this period, the return jumps to +1,185% over this period, with an annualized return of 21% - a premium of +857% over the market, and a >9% CAGR premium (9% more compounde return YoY). A significant aspect of this is the rapid growth in government spending during the decade, driving rapid revenue growth for these firms.

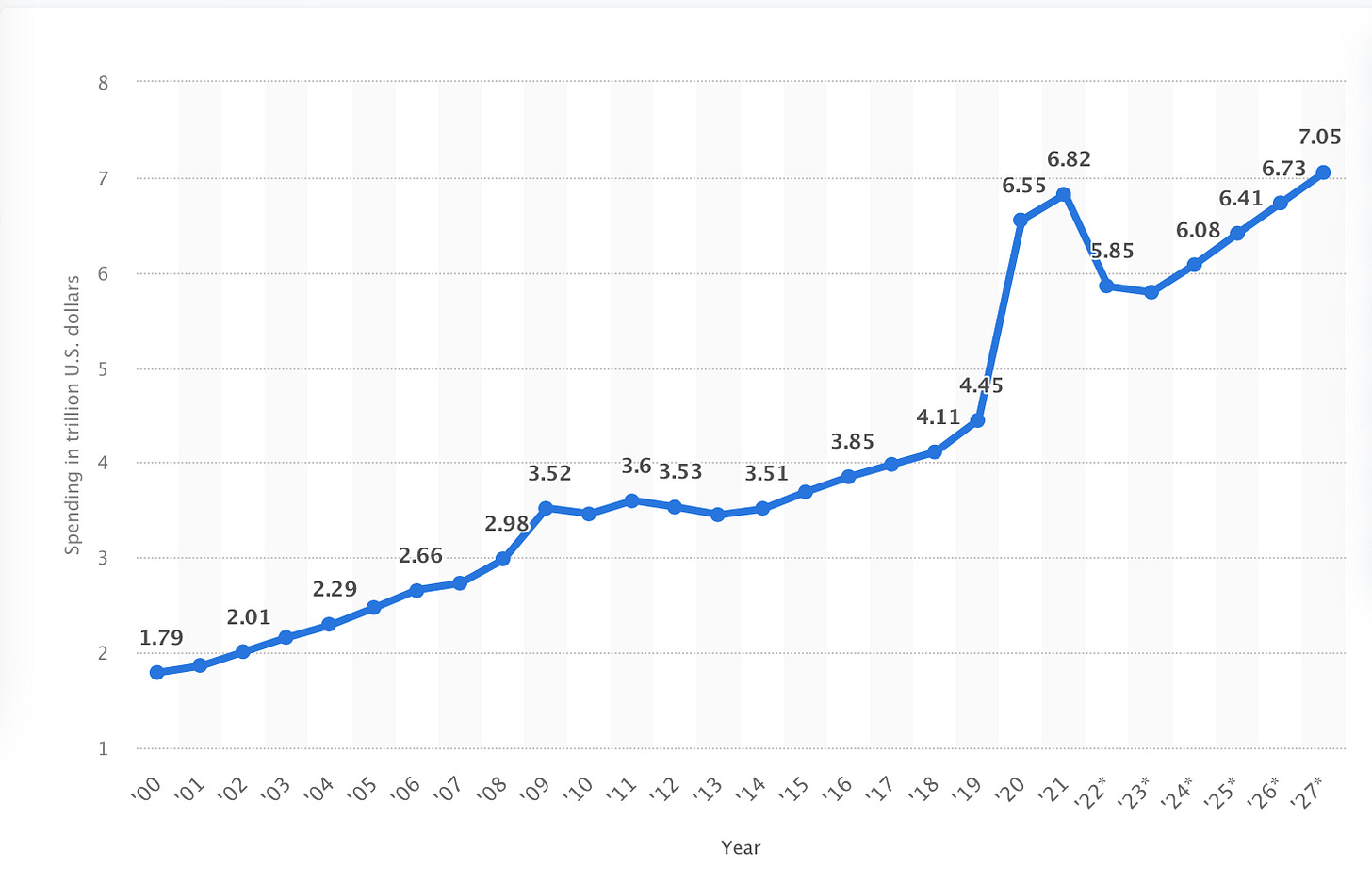

There’s strong evidence backing this strategy for the future. Government annual outlays is nearly always increasing, with the only departures from this being the difference between a recession (where spending spikes) then going down in the recovery. By 2027, total government outlays is expected to reach $7T, with a significant chunk of that going to federal contractors like those in this list.

The portfolio is live on our site, and looks to maintain strong results even in this weaker market as government spending continues - and even ramps up.

Check out the Quiver Top Gov't Contractors here: